pre and post event:

pre and post-dividends:

Filter (optional):

The filter can be used to exclude dividends with certain conditions from the analysis.

Exclude dividends with values smaller than: Event where the current value is smaller than X (Your specification).

Exclude dividends with values greater than: Event where the current value is greater than X (Your specification).

Exclude dividends with increasing values smaller than: Events in which the current value is greater than the previous value and does not exceed it by a factor of X.

Exclude dividends with increasing values greater than: Events in which the current value is greater than the previous value and exceeds it by a factor of X.

Exclude dividends with decreasing values smaller than: Events in which the current value is smaller than the previous value and exceeds it by a factor of X.

Exclude dividends with decreasing values greater than: Events in which the current value is smaller than the previous value and does not exceed it by a factor of X.

All options can be combined with each other. Several options are applied by AND link. In the "Dividends Development", you can check which events have been removed by the filters. All applied events have a red circle.

Calc: • current value < your value

Calc: • current value > your value

Calc: • if in percentage: value >= previous value & previous value to actual percentage < your value • if not in percentage: previous value - value < your value

Calc: • if in percentage: value >= previous value & previous value to actual percentage > your value • if not in percentage: previous value - current value > your value

Calc: • if in percentage: value <= previous value & previous value to actual percentage < your value • if not in percentage: value - previous value < your value

Calc: • if in percentage: value <= previous value & previous value to actual percentage > your value • if not in percentage: value - previous value > your value

This event or instrument is for subscribers only.

As a subscriber you get access to all instruments.

Furthermore, as a subscriber you have full access to our powerful Screener and Analyses Tool.

The combination of the tools makes recurring patterns so valuable.

As a subscriber you will regularly receive selected trading and investment opportunities.

Hundreds of very good entry and exit points are stored in our database.

Use our screener to take full advantage of the potential of recurring patterns.

Backtest time: -20/20 days, Dividends:20, Quarter:1,2,3,4

Average performance of the instrument on the event day:

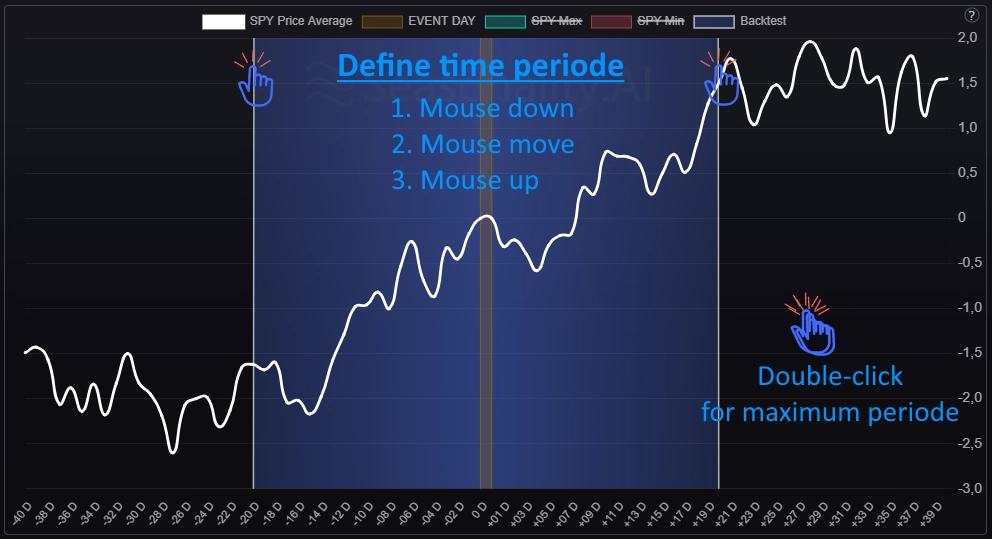

The chart shows the financial instrument's average development (white line) before and after the event.

The center of the chart marks the event day.

You can set the backtest range yourself by dragging and dropping on the chart or using the "Backtest from - to" slider.

The min and max values show the maximum range of the financial instrument before and after the event. The Min and Max values can be displayed and hidden by clicking "Min" and "Max" in the legend.

Backtest key figures:

Summarized profit: profit of the selected period of all calculated trades.

Winning trades: Percentage number of positive trades.

Average / Median profit: Average & Median profit of the selected period of all calculated trades.

Maximum drawdown: Maximum loss period in the summarized profit.

Sharp ratio: Sharp ratio shows the quality of the summarized profit in terms of profit and drawdown.

Sortino Ratio: Sortino Ratio shows the quality of the summarized profit in terms of profit and drawdown. The Sortino Ratio is our preferred metric as it does not negatively account for positive volatility.

Gains / Losses: The number of trades won and lost.

Average / Median points: Average & Median point of the selected period of all calculated trades.

Min / Max profit: Min & Max points of the selected period of all calculated trades.

0 %

Backtest result. More details can be found in the Backtest tab.

Backtest time: -20/20 days, Dividends:20, Quarter:1,2,3,4

Backtest daily:

Trading simulation for a selected period: The next two charts show the result of the simulated trades started at the beginning of the selected period and ended at the end of the period.

In the bottom table of the analysis you can find a list of individual trades with further details.

Backtest Result Key figures:

Max drawdown: Maximum loss period in the summarized profit.

Summarized profit: Profit of the selected period of all calculated years.

Sharp ratio: The sharp ratio shows the quality of the summarized profit in terms of profit and drawdown.

Sortino ratio: The sortino ratio shows the quality of the summarized profit in terms of profit and drawdown. The Sortino Ratio is the preferred metric because it does not negatively factor in positive volatility.

Count trades: Number of trades.

Improvement: The ratio shows how much the backtest development has improved from half of the selected period. A high number is a positive sign.

Backtest Result Key figures:

Average / Median profit: Average & Median profit of the selected period of all calculated trades.

Winning trades: Percentage number of positive trades.

Gains / Losses: The number of trades won and lost.

Last trade: Max drawdown: The maximum loss of the last trade that occurred during the holding period but was not realized.

Last trade: Profit: The Profit of the last trade.

Trade list:

Trade list: The trade list shows the simulated trades that are opened and closed before and after the event.

Trade list: The trade list shows the simulated trades that are opened and closed before and after the event.

| Symbol | Startdate | Startprice | Enddate | Endprice | Change | Change % | Maxrise % | Maxrise | Maxdrop % | Maxdrop | EPS / Forecast |

Revenue / Forecast |

|---|

Statistic: The statistics show the average price performance in percent, the average movement in points, the maximum and minimum movement in percent, and points for the instrument before and after the event days in different daily periods from minus 20 to plus 20 days.

| -20 | -10 | -5 | -3 | -2 | -1 | 0 | +1 | +2 | +3 | +5 | +10 | +20 |

|---|

Statistic: The statistics show the percentage development of the instrument before and after the event days in different daily periods from minus 20 to plus 20 days.

| Events | -20 | -10 | -5 | -3 | -2 | -1 | 0 | +1 | +2 | +3 | +5 | +10 | +20 |

|---|

Statistic: The statistics show the development in points of the instrument before and after the event days in different daily periods from minus 20 to plus 20 days.

| Events | -20 | -10 | -5 | -3 | -2 | -1 | 0 | +1 | +2 | +3 | +5 | +10 | +20 |

|---|

10 events

Dividend history:

The chart shows the historical dividend development in dollars and percentage per payout as well as the share price.

Dividend: Amount of the dividend in the respective currency

Yield per ex-dividend day: Yield (%) of the respective payout on the ex-dividend day

Backtest: These ex-dividend days were used in the trade calculation (Daily Development). With this data you can see which ex-dividend days were not included in the calculation of the trades due to their filters.

Price: Share price

Dividends - Result Key figures:

Symbol Stock ticker.

Yield (last year) Dividend yield calculated using the annual dividend paid and the annual closing price.

Next Dividends: When is the next dividends event.

1-Day average move after E-Release: How did the share perform in one day after dividends?

Dividends average: The average value of dividends.

Dividends average change: The average of the change from dividends to dividends.

Estimate average: The average value of dividends expectations.

Estimate average change: The average of the change from dividends expectation to dividends expectation.

Dividends to Estimate average: The average value between dividends and dividends expectations.

Dividends Standard deviation: The standard deviation from dividends to dividends.

Dividends over estimate count: How often did dividends exceed expectations?

Dividends under estimate count: As is often the case, dividends did not exceed expectations.

Dividends 1 year before: dividends value one year ago.

Dividends 1 year before change: Percentage change in dividends one year ago compared to the last dividends.

Dividends count: Number of dividends analyzed.

Years of data: Number of years analyzed.

after E-Release

change

before

before change

Dividends statistic: The following table shows statistical data on dividends and their expectations.

The colors of the headings are the same as the data in the Dividends Development Chart.

| Symbol | Quarter | Average Dividends | Average Dividends Change | Average Estimate | Average Estimate Change | Average Dividends to Estimate | Dividends over/under Estimate Count |

1-Day Move after Release |

Average 1 Year Before | Average 1 Year Before Change |

|---|

Dividends development: The following table shows statistical data on dividends development and their expectations for the respective publication.

The colors of the headings are the same as the data in the Dividends Development Chart.

| Symbol | Symbol price | Year | Quarter | Dividends | Dividends Change | Estimate | Estimate Change | Dividends to Estimate | 1-Day Move after Release |

1 Year Before | 1 Year Before Change |

|---|