pre and post event:

Event analysis: The analysis shows the development of the instrument (stock, ETFs, currency, future, etc.) before, after, and at the time of the last event.

Intraday (if available) and daily data are analyzed from the symbol or instrument data.

The average developments before and after the event are analyzed daily for the instrument data.

Backtests are used to show the quality of the price development before and after the event times.

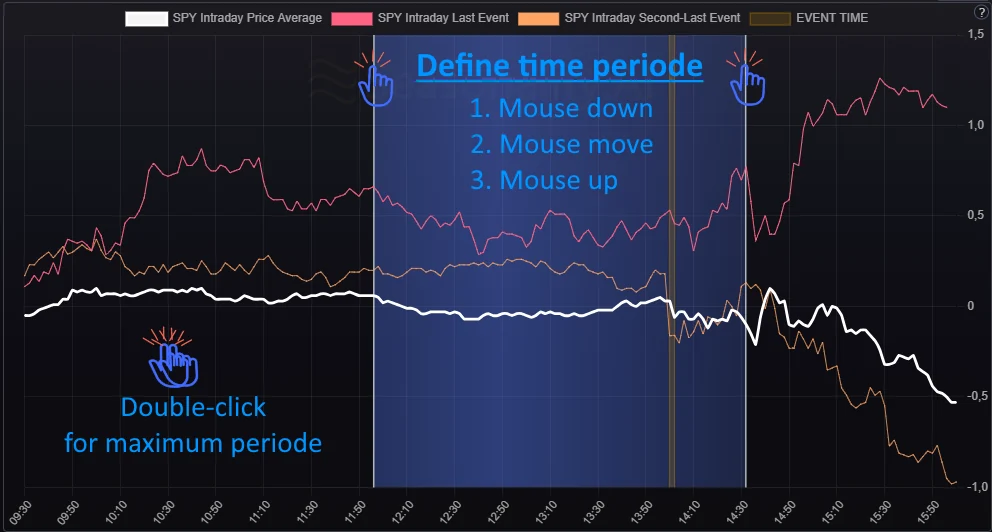

The intraday analysis shows the average price development of the instrument on the event days.

The intraday backtest shows two results. The first backtest analyzes the intraday development before the event, and the second backtest after the event. Only the first or second backtest is applied if the event is outside the instrument trading hours.

Filter (optional):

The filter can be used to exclude events with certain conditions from the analysis.

Exclude events with values smaller than: Event where the current value is smaller than X (Your specification).

Exclude events with values greater than: Event where the current value is greater than X (Your specification).

Exclude events with a positive suprise smaller than: Events for which the current value is greater than the forecast and does not exceed it by a factor of X.

Exclude events with a positive suprise greater than: Events for which the current value is greater than the prediction and exceeds it by a factor of X.

Exclude events with a negative surprise smaller than: Events for which the current value is smaller than the forecast and does not exceed it by a factor of X.

Exclude events with a negative surprise greater than: Events for which the current value is smaller than the forecast and exceeds it by a factor of X.

Exclude events with increasing values smaller than: Events in which the current value is greater than the previous value and does not exceed it by a factor of X.

Exclude events with increasing values greater than: Events in which the current value is greater than the previous value and exceeds it by a factor of X.

Exclude events with decreasing values smaller than: Events in which the current value is smaller than the previous value and exceeds it by a factor of X.

Exclude events with decreasing values greater than: Events in which the current value is smaller than the previous value and does not exceed it by a factor of X.

Exclude events with a positive forecast smaller than: Events for which the current forecast is greater than the previous forecast and does not exceed it by a factor of X.

Exclude events with a positive forecast greater than: Events for which the current forecast is greater than the previous forecast and exceeds it by a factor of X.

Exclude events with a negative forecast smaller than: Events for which the current forecast is smaller than the previous forecast and does not exceed it by a factor of X.

Exclude events with a negative forecast greater than: Events for which the current forecast is greater than the previous forecast and exceeds it by a factor of X.

All options can be combined with each other. Several options are applied by AND link. In the "Event History", you can check which events have been removed by the filters. All applied events have a red circle.

Calc: • current value < your value

Calc: • current value > your value

Calc: • if in percentage: forecast <= value & forecast to actual percentage < your value • if not in percentage: forecast - value < your value

Calc: • if in percentage: forecast <= value & forecast to actual percentage > your value • if not in percentage: forecast - value > your value

Calc: • if in percentage: forecast >= value & forecast to actual percentage < your value • if not in percentage: value - forecast < your value

Calc: • if in percentage: forecast >= value & forecast to actual percentage > your value • if not in percentage: value - forecast > your value

Calc: • if in percentage: value >= previous value & previous value to actual percentage < your value • if not in percentage: previous value - value < your value

Calc: • if in percentage: value >= previous value & previous value to actual percentage > your value • if not in percentage: previous value - current value > your value

Calc: • if in percentage: value <= previous value & previous value to actual percentage < your value • if not in percentage: value - previous value < your value

Calc: • if in percentage: value <= previous value & previous value to actual percentage > your value • if not in percentage: value - previous value > your value

Calc: • if in percentage: forecast >= previous forecast & previous forecast to forecast percentage < your value • if not in percentage: previous forecast - forecast < your value

Calc: • if in percentage: forecast >= previous forecast & previous forecast to forecast percentage > your value • if not in percentage: previous forecast - forecast > your value

Calc: • if in percentage: forecast <= previous forecast & previous forecast to forecast percentage < your value • if not in percentage: forecast - previous forecast < your value

Calc: • if in percentage: forecast <= previous forecast & previous forecast to forecast percentage > your value • if not in percentage: forecast - previous forecast > your value

This event or instrument is for subscribers only.

As a subscriber you get access to all instruments and events.

Furthermore, as a subscriber you have full access to our powerful Analyses Tool.

As a subscriber you will regularly receive selected trading and investment opportunities.

Intraday Backtest

Intraday instrument development: The chart shows the average performance of the financial instrument on the event day.

The yellow vertical bar of the chart marks the time of the event. If the time is outside the regular trading hours, the time of the event will be displayed only for a few instruments. In this case, we recommend switching the instrument to futures and currencies if possible.

Backtest key figures:

Summarized profit: profit of the selected period of all calculated trades.

Winning trades: Percentage number of positive trades.

Average / Median profit: Average & Median profit of the selected period of all calculated trades.

Maximum drawdown: Maximum loss period in the summarized profit.

Sharp ratio: Sharp ratio shows the quality of the summarized profit in terms of profit and drawdown.

Sortino Ratio: Sortino Ratio shows the quality of the summarized profit in terms of profit and drawdown. The Sortino Ratio is our preferred metric as it does not negatively account for positive volatility.

Tradedays (Sum): Number of trading days in backtest

Gains / Losses: The number of trades won and lost.

Count Events < Estimate

Backtest result. More details can be found in the Backtest tab.

Intraday Backtest

Pre event intraday backtest: Intraday backtest for the time before the event time.

If the event time is before the start of regular trading hours, this backtest is not created.

Backtest Result Key figures:

Max drawdown: Maximum loss period in the summarized profit.

Summarized profit: Profit of the selected period of all calculated years.

Sharp ratio: The sharp ratio shows the quality of the summarized profit in terms of profit and drawdown.

Sortino ratio: The sortino ratio shows the quality of the summarized profit in terms of profit and drawdown. The Sortino Ratio is the preferred metric because it does not negatively factor in positive volatility.

Count trades: Number of trades.

Improvement: The ratio shows how much the backtest development has improved from half of the selected period. A high number is a positive sign.

Gains / Losses: The number of trades won and lost.

Backtest Result Key figures:

Average / Median profit: Average & Median profit in percent of the selected period of all calculated trades.

Winning trades: Percentage number of positive trades.

Average / Median point's: Average / Median profit in points of the selected period of all calculated trades.

Last trade: point's: The Profit in points of the last trade.

Min point's: The minimum profit in points from the list of all calculated trades.

Max point's: The maximum profit in points from the list of all calculated trades.

Last trade: Max drawdown: The maximum loss of the last trade that occurred during the holding period but was not realized.

Last trade: Profit: The Profit in percent of the last trade.

Intraday-Trade simulation of the selected event day (Trade List)

Intraday-Trade list: The trading list shows the trades simulated by the two intraday backtests.

Intraday-Trade list: The trading list shows the trades simulated by the two intraday backtests.

| Symbol | Startdate | Startprice | Enddate | Endprice | Change | Change % | Maxrise % | Maxdrop % |

|---|

Event - Result Key figures:

Event: Event short name.

Local event time: Event intraday time. If the time is outside the regular trading hours, the time of the event will be displayed only for a few instruments. In this case, we recommend switching the instrument to futures and currencies if possible.

Instrument - Result Key figures:

Event Day Average: Average development from open to close.

Gains / Losses: The number of trades won and lost.

Event Day Min: Development of the worst daily development from open to close.

Event Day Max: Development of the best daily development from open to close.

Statistic: The statistics show the average performance in percent, the average movement in points, the maximum and minimum movement in percent and points for the instrument before and after the event in different minute periods.

| Open | -2 hours | -1 hour | -30 minutes | -20 minutes | -10 minutes | -5 minutes | Event | +5 minutes | +10 minutes | +20 minutes | +30 minutes | +1 hour | +2 hours | Close |

|---|

Statistic: The statistics show the percentage development of the instrument before and after the event in different periods.

| Open | -2 hours | -1 hour | -30 minutes | -20 minutes | -10 minutes | -5 minutes | Event | +5 minutes | +10 minutes | +20 minutes | +30 minutes | +1 hour | +2 hours | Close |

|---|

Statistic: The statistics show the development in points of the instrument before and after the event in different periods.

| Open | -2 hours | -1 hour | -30 minutes | -20 minutes | -10 minutes | -5 minutes | Event | +5 minutes | +10 minutes | +20 minutes | +30 minutes | +1 hour | +2 hours | Close |

|---|

10 events

Event history:

The chart shows the historical course of the event.

Events with a blue background are used for analysis and can be controlled via the filter function.

The stastitic shows general key figures of the event.

Event Development: The chart shows the historical data of the event. Events with a blue background are used for analysis and can be controlled via the filter function.

Event - Result Key figures:

Event Event short name.

Time Event intraday time.

Count events: Number of analyzed events.

Years of data: Number of analyzed years.

Standard deviation: Standard deviation of event data (Actual).

Average: Average development of event data (Actual).

Interval: Number of events per year.

Source: Source of event data.