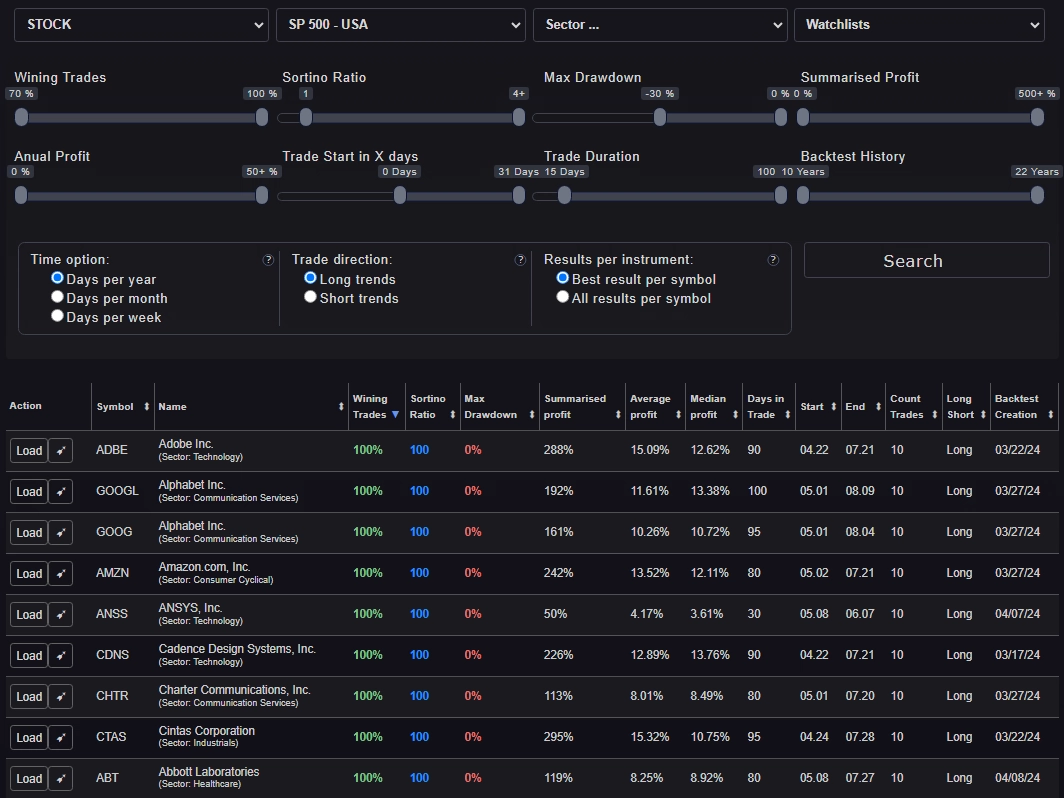

Seasonality Screener

Our Seasonality Screener identifies recurring patterns with hit rates of over 90%.

There are hundreds of highly profitable recurring patterns in our database.

With just a few clicks you get new results.

With just a few clicks you get new results.

When is the Best Time to Buy or Sell?

Recurring Pricing Patterns Improve Timing!

Our database contains hundreds of grand entry and exit points.

The Seasonality Screener is part of our Seasonal Essentials program, which includes two other powerful tools for analysing recurring price patterns.

We also offer an intraday seasonality screener.

How does the Seasonal Screener Work?

1. Define your preferred Asset Class

If you want to view stocks, you can refine your search by selecting an index or sector. You can filter by currency, country of origin, sector, industry, or market capitalization.

2. Define the Quality Criteria for the Seasonal Patterns

You can still search for long and short trades.

You can have more than one result per symbol.

And you can choose between different periods. There are three to choose from:

- Days per Year

- Days per Month

- Days per Week

Expanding on Stock Market Seasonality with the Seasonality Screener

Discovering Advanced Seasonal Patterns

The Seasonality Screener is a powerful tool designed to uncover advanced seasonal patterns in the stock market. By examining detailed historical data, this tool goes beyond basic trends to identify specific times, days, and weeks when certain stocks have shown consistent performance patterns. This allows traders to make more informed decisions based on high-probability periods for market movements.

Maximizing Analysis with Cutting-Edge Technology

Our Seasonality Screener leverages state-of-the-art technology to provide comprehensive seasonal analysis. Users can:

- Analyze Intraday Seasonal Patterns: Discover how stock prices behave at different times throughout the trading day.

- Compare Historical Trends: Contrast seasonal trends across various assets to identify the most reliable patterns.

- Optimize Trading Strategies: Utilize the screener to develop and backtest trading strategies based on identified seasonal patterns, improving their effectiveness and reliability.

Advantages of Using the Seasonality Screener

Incorporating the Seasonality Screener into your trading arsenal provides several key benefits:

- Precise Entry and Exit Points: Seasonal analysis helps determine the best times to enter or exit trades, reducing risk and enhancing returns.

- Enhanced Risk Management: Understanding seasonal trends aids in predicting market volatility and adjusting strategies accordingly.

- Better Portfolio Diversification: By identifying patterns in various asset classes, traders can diversify their portfolios more effectively.

Implementing Seasonal Insights

To effectively use the Seasonality Screener:

- Regularly Update Historical Data: Keep your historical price movement data up-to-date and analyze it frequently to detect new or evolving patterns.

- Integrate with Other Analysis Techniques: Combine seasonal analysis with technical and fundamental analysis for a well-rounded trading strategy.

- Stay Informed on Market News: Seasonal patterns can be influenced by current events and economic reports. Staying informed ensures your seasonal analysis remains accurate and relevant.

Conclusion

Expanding your understanding of stock market seasonality with the Seasonality Screener allows you to uncover hidden opportunities and enhance your trading strategies. Seasonality.ai provides the tools and resources necessary to delve deeply into these patterns, ensuring you stay competitive in the trading landscape.

For more detailed insights and to start leveraging advanced seasonal analysis, explore our comprehensive tools and resources at Seasonality.ai.

Professional analysis tools for your success

All three Seasonality tools are part of the Seasonality Essential subscriber offer.

Get full access as a member!

Seasonality.ai

Identifying trading & investment opportunities has never been easier.

If you have any questions or suggestions, please do not hesitate to email us.