US Institutional Protection Indicator

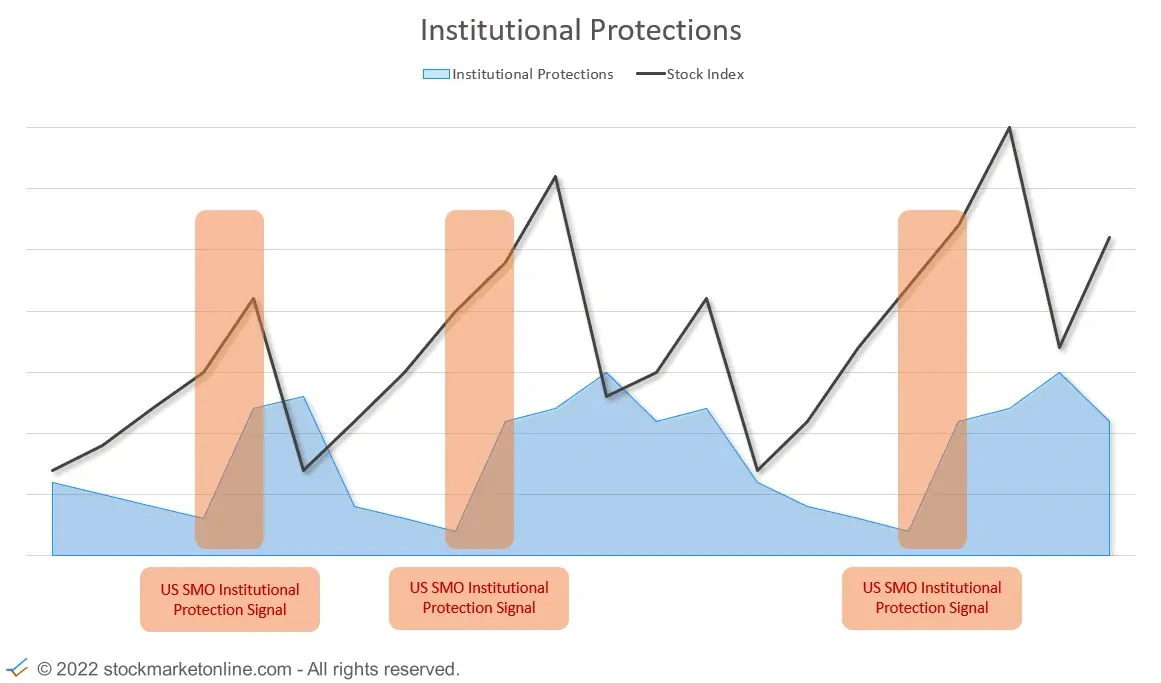

The US Institutional Protection Indicator shows the increase of hedges and reallocations of institutional investors for the us stock market.

This behavior can often be seen a few days or weeks before a stock market decline.

US Institutional Protection Indicator

Institutional investors are usually better informed and implement a consistent hedging strategy.

This indicator shows the hedging behavior of institutional investors in relation to the price development of the stock market.

A signal is displayed if these two trends are different and exceed threshold values. This behavior can often be seen a few days or weeks before a stock market decline.

The hedges of the institutional investors usually have a maturity of 30-60 days. Depending on the situation, more extended periods are also possible.

Use the US Institutional Protection Indicator to optimize your investment and trading activities.

-

Protect your portfolio.

-

Check your LONG positions.

-

If you are a trader, SHORT trade opportunities may arise.

If the hedges of the institutional investors had a maturity of plus-minus 30-60 days, then the price declines in the S & P 500 or Dow Jones could be hedged very well.

Chart: US Institutional Protection Indicator

How it works!

The US Institutional Protection Indicator shows the increase in hedging and reallocation by institutional investors for the American stock market.

This behavior can often be seen a few days or weeks before a stock market decline.

In 'normal' market phases, when stock prices are rising, the need for hedging by institutional investors decreases.

When stock prices rise, institutional investors' hedging increases and a signal is displayed.

The picture shows the rough functioning of the indicator.